Make the most of the tax benefits provided by the startup law.

The recent Startup Law has brought significant changes to the Spanish entrepreneurial scene by introducing specific tax benefits aimed at boosting the growth of the entrepreneurial ecosystem and favoring startups and investors.

Published

Type

Reading Time

In this post, we will analyze in detail the tax benefits of this law, exploring how these tax measures offer a very favorable tax regime for both companies, their investors, and workers.

Keep reading to learn more about the opportunities that this law offers you.

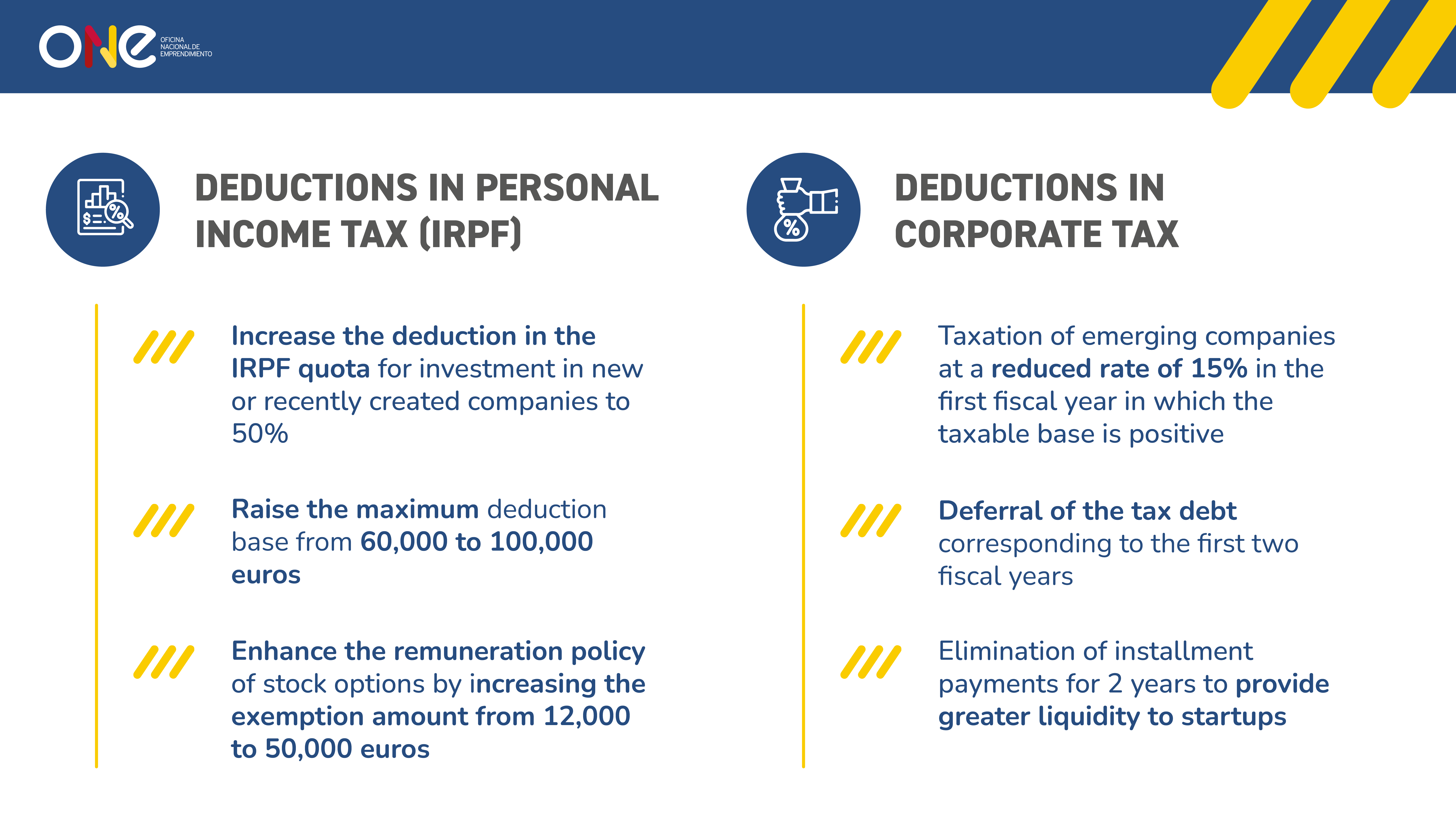

Deductions in the Personal Income Tax

The startup law aims to promote investment in emerging companies and support the growth of the entrepreneurial ecosystem. Here are the key points related to deductions and exemptions in the Personal Income Tax (PIT) for investments in startups.

One of the main tax benefits of the new startup law is deductions in the PIT quota. The deduction in the PIT quota for investment in newly established or recently created companies is increased to 50%, and the maximum deduction base is raised from €60,000.00 to €100,000.00. Investments must be made in companies that meet the following requirements:

- Being a commercial company (S.A or S.L.) and not being listed for trading on any stock exchange or multilateral trading system, whether Spanish or foreign.

- Engaging in an economic activity equipped with the necessary personnel and material resources for its development.

- Not having more than €400,000 in equity at the beginning of the tax period in which the taxpayer acquires the shares or stakes.

Furthermore, it is important to note that, in order to benefit from these advantages, the acquisition of shares or stakes must take place at the time of the startup's incorporation or, at most, within the following five years, and it must remain in their portfolio for a period exceeding three years but less than twelve.

For instance, let's consider an individual investor who decides to support a startup and invests €80,000.00. Let's see how the tax benefits impact this investor:

- Tax deduction: €80,000.00 * 50% = €40,000.00

- Maximum base: €100,000.00, so the investor can take full advantage of their deduction.

- Impact on taxation: Let's assume that the individual investor's PIT quota before the deduction is €15,000.00. In this scenario, prior to the startup law, the investor would have to pay the quota of €15,000.00. However, with the new law, since the maximum deduction limit is not exceeded (in this case, €40,000.00), the €15,000.00 is exempt from PIT taxation, thus promoting investment in startups.

Similarly, the law includes an increase in the exemption from taxation on gains when shares or stock options are granted to employees, who can now apply for an exemption on their gains. In this case, the exemption is increased from €12,000.00 annually, before the startup law, to €50,000.00 after the law comes into effect.

Before the startup law, if a company granted shares worth a total of €15,000.00 to an employee, the employee had to pay taxes on the amount exceeding the exemption. That is, they were taxed on €3,000.00 (€15,000.00 - €12,000.00).

With the new law, the exemption has been increased to €50,000.00 annually. In this case, if the company grants shares worth a total of €15,000.00 to an employee, they will not have to pay taxes on the grant, as it does not exceed the exemption limit.

Additionally, the new law includes a special attribution rule for income exceeding the exempt amount of the mentioned stock options. These incomes will be attributed when the company is sold, goes public, or ten years have passed since the delivery of the shares or stakes.

Another example: if 1,000 stock options are granted at a unit price of €1.00, valued in the market at €10.00 each stock option, taxes must be paid on the difference between their value (1,000 x €10.00) and their price (1,000 x €1.00). If a 45% PIT is applied, €4,050.00 must be paid ((€10,000.00 - €1,000.00) x 45%).

With the new law, this taxation will disappear until the shares are sold, the startup goes public, or ten years have passed.

Deductions in the Corporate Income Tax

The Startup Law includes tax benefits designed to encourage the development and growth of your startup through reduced and deferred taxation in the Corporate Income Tax.

- Taxation of emerging companies at the reduced rate of 15%: a reduced rate of 15% is established for the first fiscal year in which the taxable base is positive. This reduced rate extends to the following three years, provided that the condition of an emerging company is maintained.

Let's consider an example:

A startup has a taxable base of €100,000.00 in its first year of operation.

Before the new law, the tax rate for all companies was 25%. The company would therefore have to pay a total of €25,000.00 (€100,000.00 x 25%) in taxes.

With the startup law, emerging companies are taxed at 15% for the first three years. In this case, the Corporate Income Tax payable will be €15,000.00 (€100,000.00 x 15%).

- Elimination of installment payments: The obligation to make installment payments is exempted for the 2 years following the one in which the taxable base becomes positive. This way, your startup has greater liquidity during those initial years of positive taxable bases.

- Deferral of tax debt: The possibility of requesting a deferral of the tax debt corresponding to the first two tax years in which the taxable base of the Corporate Income Tax is positive is introduced. The deferral period will be 12 months in the first year and 6 months in the second. With this change, the company has greater flexibility to access its cash flow.

The Startup Law has established a regulatory framework that not only simplifies the creation and development of startups but also promotes investment, innovation, and expansion of these companies. These measures not only benefit entrepreneurs and startups but also make Spain a more competitive and attractive destination for foreign investors and professionals, contributing to the growth of the startup ecosystem in the country.